On August 21st, the Los Angeles City Council convened a Revenue Day to discuss ways to generate, enhance or improve collection of city revenue.

The city’s Chief Administrative Officer (CAO) Miguel Santana stressed that after years of deep budget cuts, the city is left with few options to address ongoing budget deficits. Without a new revenue source adopted by July 1, 2013, he said he was “without a clue” about how to address next year’s deficit. In particular, funding for firefighters, paramedics and police would be in jeopardy because public safety accounts for 70% of general fund spending. The CAO report is available here and the presentation is here.

Chief Legislative Analyst (CLA) Gerry Miller, reporting on options for city revenue, noted that the city has had no new General Fund tax revenues in the 16 years since the passage of Prop 218, which requires voter approval for new taxes. The CLA report is availablehere.

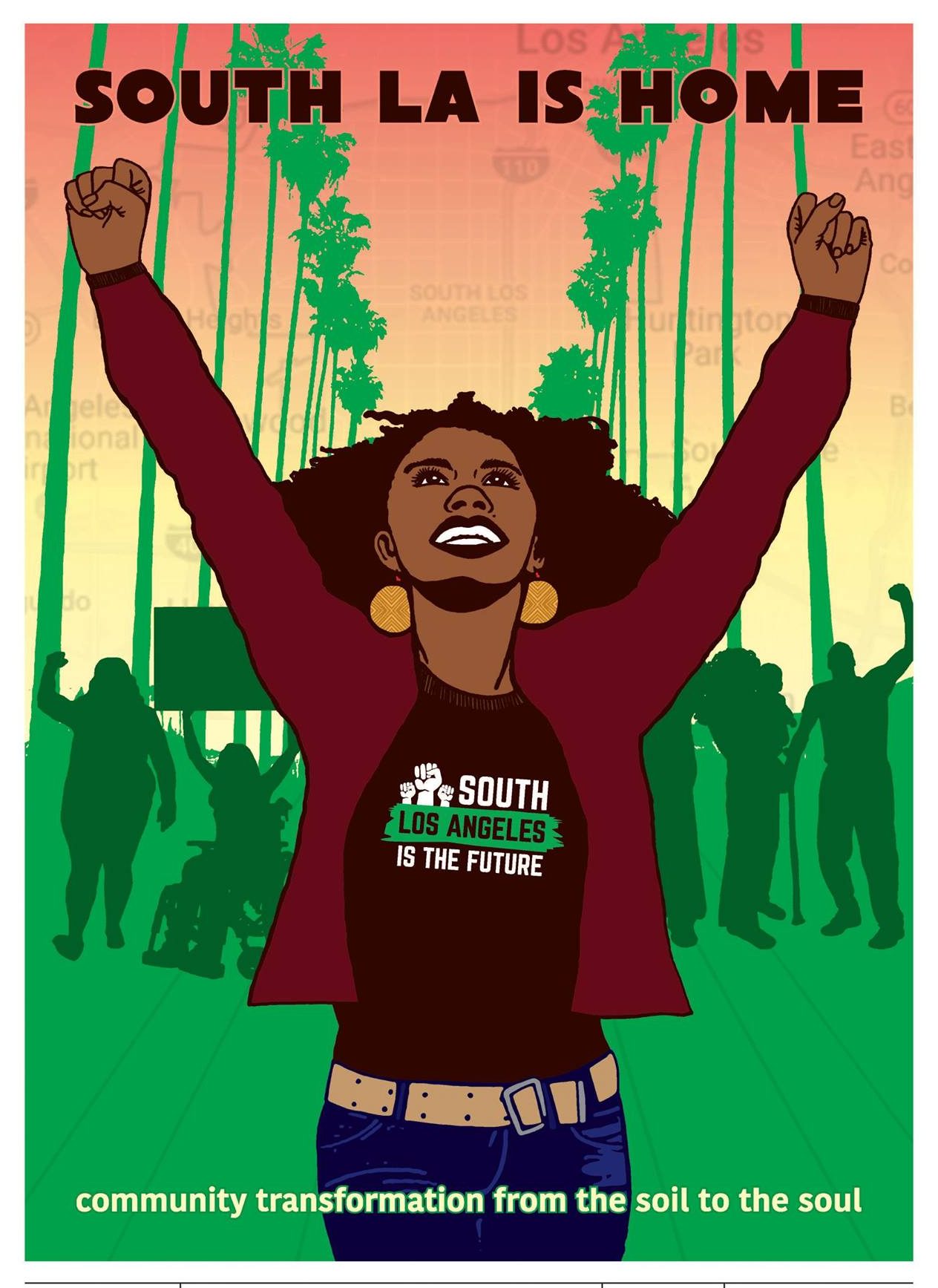

In August, SCOPE partnered with SEIU Local 721 and UFCW Local 770 to poll 2,973 voters in and around South Los Angeles to learn their opinions about the city budget and neighborhood business issues.

The full results are forthcoming but here are some highlights of what we learned:

- 76% of voters surveyed think the City of Los Angeles should continue to collect a tax on businesses located or working in the city, an issue we have blogged about in the past.

- 46% of voters support increasing the city Documentary Transfer Tax, the tax paid when property is sold. 39% oppose this increase and 15% are undecided.

- 62% of voters support a sliding-scale increase to the city Documentary Transfer Tax so that higher-valued properties pay a larger percentage. 24% oppose this increase and 14% are undecided.

- An overwhelming 87% of voters think the city should tax oil drillers.

Based on the reports and recommendations from the CAO and CLA, the Council voted 12-1 to move forward to explore two potential revenue measures for the March 2013 ballot. Check out this KPCC story for some quotes from City Council members, including Dennis Zine who voted against further analysis.

The first proposal would increase the Documentary Transfer Tax, the tax paid when real estate property is sold, from $4.50 to $9.00 per $1,000 property value, raising an additional $108 million per year for the city’s General Fund. The CAO also recommends that any additional revenue raised would go toward one-time costs, such as infrastructure, or be set aside in the city’s Reserve Fund. During public comment, representatives from the real estate and business sectors turned out to oppose the tax increase because they think it will discourage property sales.

The second proposal under consideration would increase the Parking Occupancy Tax from 10% to 15% on parking fees collected from patrons at parking lots and garages. The CAO estimates this would raise an additional $45 million per year for the city’s General Fund.

We’ll hear more about these proposals as the October 31st deadline approaches for City Council to place measures on the March 2013 citywide ballot. In the meantime, let us know what you think. Would you support increasing the city Documentary Transfer Tax and/or the Parking Occupancy Tax?